| Drilling at Pan Asia Metals Ltd.’s Reung Kiet lithium project in Thailand. The country is a Southeast Asian hub of the electric vehicle battery supply chain, according to Pan Asia Chairman Paul Lock. Source: Pan Asia Metals |

Asia will continue to be the biggest driver of demand for electric vehicle battery metals over the next decade, despite hefty US and European incentives that encourage investment.

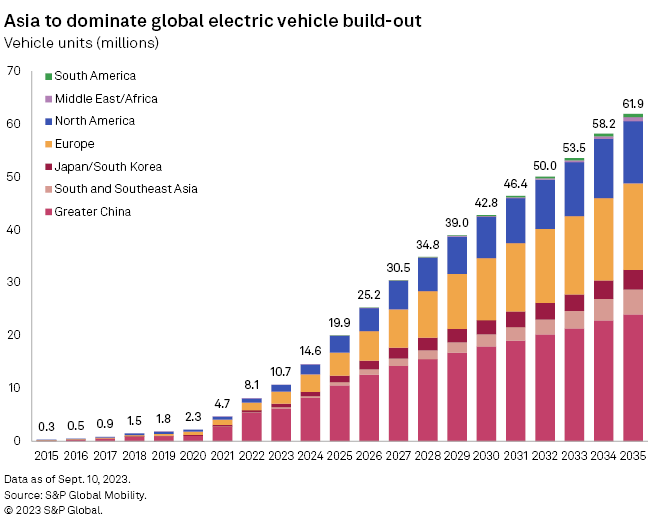

Greater China, Japan and South Korea still collectively dominate EV production and will continue to, according to the latest forecast by S&P Global Mobility published in August. The rising market share of South and Southeast Asia — including India, Indonesia, Malaysia, Pakistan, Singapore, Thailand and Vietnam — will overtake Japan and South Korea’s combined shares by 2033.

The US Inflation Reduction Act (IRA) has drawn a flurry of investment to the US battery supply chain in the year since its passage, and the EU is trying to accelerate its EV manufacturing through the Net-Zero Industry Act.

“We hear a lot of talk about the IRA and the EU’s response, but the reality is that, at this point, more than 55% of [internal combustion engine] vehicles are made in Asia, and if you look at the Asian policy environment, there’s no way they’re going to let go [of that lead] — not without a fight,” Pan Asia Metals Ltd. Chairman Paul Lock said Sept. 5 at the New World Metals Investment Series in Perth, Australia.

Record Chinese EV sales

Lock expects Asia to continue to lead car manufacturing as its growing population and “massive emerging middle class” will drive immense demand for two-, three- and four-wheel EVs.

China’s EV sales hit a monthly record high in August, and its output of power batteries and energy storage batteries — a key indicator of battery metals demand — jumped 46.8% from a year earlier, S&P Global Commodity Insights reported, citing data from the China Association of Automobile Manufacturers and the China Automotive Battery Innovation Alliance.

Chinese automakers are dominating in Europe “because the cost of production for an EV in China is so much lower,” Cameron Perks, principal lithium analyst at Benchmark Mineral Intelligence, said at the Perth conference.

“Something needs to be done to equalize the playing field,” Perks said. China already has subsidized capital and economic clustering, which makes it tough for other jurisdictions to compete.

Research and development centers are generally built around EV production facilities, and then cell and cathode plants are built nearby. These complexes are typically built in high-population centers, a model “that has already taken off in China, Japan and South Korea,” Perks said.

Southeast Asia’s potential

Lock sees booming opportunities in Southeast Asia, which “is a big manufacturer for one reason: It’s a low-cost environment.”

Australian lithium producer Mineral Resources Ltd. is looking at the possibility of building a lithium conversion facility in Southeast Asia, Managing Director Chris Ellison said in a fiscal 2023 results presentation. The company restructured a joint venture in Western Australia and will no longer invest in Chinese conversion assets with Albemarle Corp.

In August, Blackstone Minerals Ltd.’s Ta Khoa project was added to the Vietnamese National Mineral Master Plan. Ta Khoa includes the planned Ban Phuc nickel mine and concentrator, and a refinery capable of producing both nickel-cobalt-manganese precursor cathode active material and nickel sulfate.

Vietnam Rare Earths JSC, one of the world’s only non-Chinese rare earths refiners, approached Blackstone recently to help develop Dong Pao, a “world-class rare earth deposit which has been known about since the 1960s” but has not been accessed.

Indonesia is building a domestic EV supply chain by leveraging its 48.6% global market share in nickel, a key ingredient for batteries. The country aims to have 2.5 million EV users by 2025, although analysts have questioned whether it can move that quickly, given its low production capacity and drivers’ reluctance to shift to EVs.

“We have the ability to produce nickel, all the way to electric vehicles, which is what’s going to happen in Indonesia, and it’s already happening in China. So there’s no reason why you wouldn’t get that right through Southeast Asia,” Scott Williamson, Blackstone’s managing director, told Commodity Insights.

‘Playing catch-up’

The US and Europe both face challenges in expanding EV production despite the recent policy successes.

The IRA encourages original equipment manufacturer investment from two angles: tying the consumer-level tax credit to North American sourcing and assembly and offering incentives that lower the cost of developing manufacturing, Jamal Amir, principal research analyst at Mobility, said in an email interview.

“However, for a brand with vehicles above the price cap or with consumers who have household income higher than the limit for that, they won’t be eligible no matter where they build, so the consumer incentive won’t matter,” Amir said. “Those OEMs would still be eligible for the manufacturing credit, though, and that could be enough to tip the scale.”

In Europe, decades of inaction on incentivizing mining and relying on Africa for minerals for too long has left the EU in a losing position, according to Keith Coughlan, executive chairman of European Metals Holdings Ltd., whose Cinovec project is Europe’s largest hard-rock lithium resource.

“The EU is all in on the energy transition, building a battery industry and commitment to an EV future,” Coughlan told Commodity Insights. “But after making those commitments, they realized they dissuaded mining for quite a few decades now and don’t have the critical raw materials to enable that transition.”

“European Commission President Ursula von der Leyen has said they don’t want to rely on China for lithium or rare earths, so they’re playing catch-up — and frankly they’re coming last in the world in terms of securing any sort of supply chains to enable the energy transition,” Coughlan said.

S&P Global Mobility and S&P Global Commodity Insights are divisions of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Author: Anthony Barich

Theme: Metals Retail & Consumer Products

Read the full article on S&P Global here: Asia to dominate global EV metals demand despite US, EU incentives | S&P Global Market Intelligence (spglobal.com)